What Is A Normal Short Ratio . short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. A short interest ratio is the number of shares or units of a security that have been sold. short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. the short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. what is a short interest ratio?

from www.youtube.com

a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. A short interest ratio is the number of shares or units of a security that have been sold. what is a short interest ratio? the short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase. short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a.

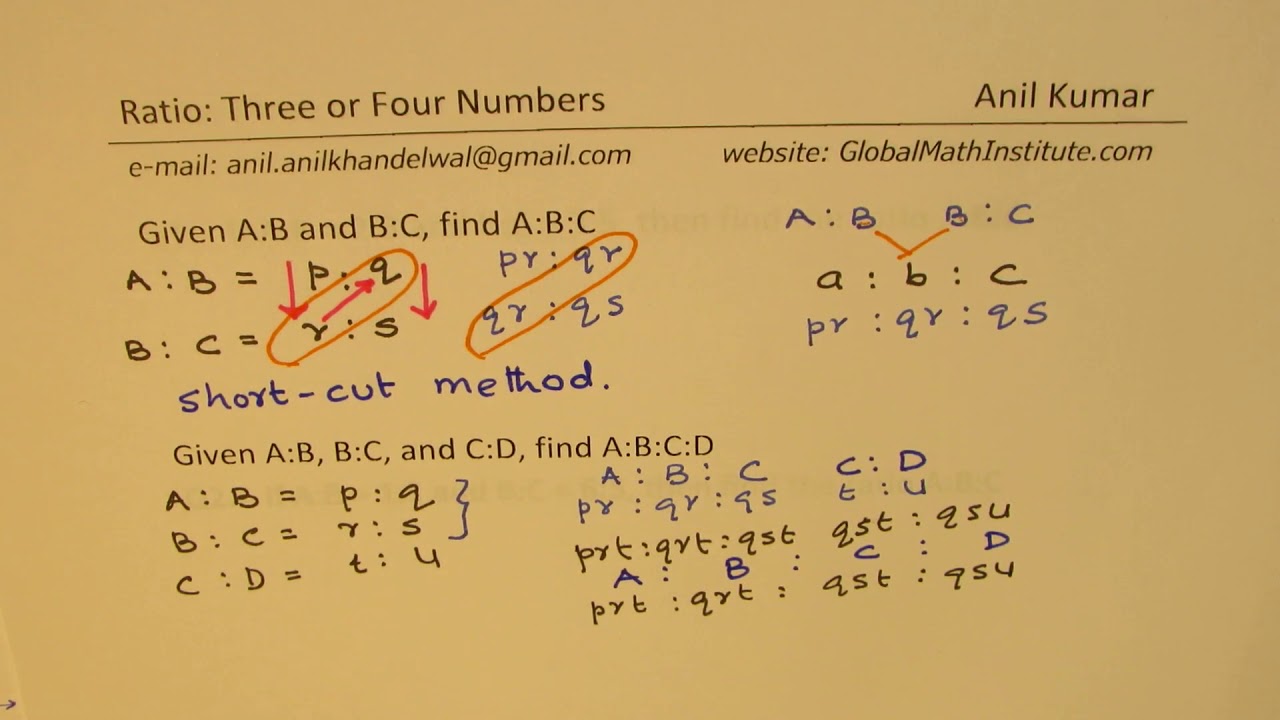

Ratio with three or four numbers ABCD Shortcut Trick SSC GCSE SAT

What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. A short interest ratio is the number of shares or units of a security that have been sold. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. the short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase. what is a short interest ratio? a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a.

From www.quora.com

What is the longshort ratio? Quora What Is A Normal Short Ratio what is a short interest ratio? a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. the short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase. A short interest ratio is the. What Is A Normal Short Ratio.

From www.onlinemath4all.com

Trigonometric Ratio Table What Is A Normal Short Ratio short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. short interest is the total number of shares of a particular stock. What Is A Normal Short Ratio.

From www.stockgro.club

Ratio analysis shortcut to understanding a company’s financials What Is A Normal Short Ratio short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. A short interest ratio is the number of shares or units of a security that have been sold. a short ratio, also known as the short interest ratio or days to cover, is a financial term that. What Is A Normal Short Ratio.

From www.youtube.com

Ratio and proportionhow to solve Ratio and proportion easily?Shortcut What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. what is a short interest ratio? short interest is the total. What Is A Normal Short Ratio.

From creataclasses.com

TECHNIQUE TO REMEMBER TRIGONOMETRIC RATIO TABLE CREATA CLASSES What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. the short interest ratio is a. What Is A Normal Short Ratio.

From www.youtube.com

SHORTCUT FOR RATIO AND PROPORTION RATIO & PROPORTION SHORTCUT What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. what is a short interest ratio? a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. A short interest ratio is the. What Is A Normal Short Ratio.

From www.teachoo.com

Example 6 Mean deviation Normal & Shortcut Method Examples What Is A Normal Short Ratio A short interest ratio is the number of shares or units of a security that have been sold. short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. what is a short interest ratio? a short interest ratio, often referred to as the days to cover. What Is A Normal Short Ratio.

From www.youtube.com

Algebra 1 How to Find the Common Ratio of Geometric Sequences What Is A Normal Short Ratio what is a short interest ratio? short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. A short interest ratio is the. What Is A Normal Short Ratio.

From www.whyiexercise.com

Waisttohip ratio Reliable research shows if you need to lose weight What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. what is a short interest ratio? a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. the short interest ratio is. What Is A Normal Short Ratio.

From globaltradingsoftware.com

What Is Short Ratio — Global Trading Software Guide What Is A Normal Short Ratio what is a short interest ratio? short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. A short interest ratio is the number of shares or units of a security that have been sold. a short interest ratio, often referred to as the days to cover. What Is A Normal Short Ratio.

From www.kapwing.com

The Ultimate Guide to Social Media Aspect Ratios for 2023 What Is A Normal Short Ratio a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. short ratio takes the number of shares of a stock currently sold. What Is A Normal Short Ratio.

From www.youtube.com

Understanding FII Long Short Ratio How to calculate FII (Long Short What Is A Normal Short Ratio A short interest ratio is the number of shares or units of a security that have been sold. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. short interest is the total number of shares of a particular stock that have been sold short by investors. What Is A Normal Short Ratio.

From teachoo.com

Example 6 Mean deviation Normal & Shortcut Method Examples What Is A Normal Short Ratio A short interest ratio is the number of shares or units of a security that have been sold. a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. what is a short interest ratio? short ratio takes the number of shares of a stock currently sold. What Is A Normal Short Ratio.

From www.youtube.com

Trigonometry Ratio Values Shortcut Method Maths Trigonometry Class What Is A Normal Short Ratio short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. what is a short interest ratio? A short interest ratio is the number of shares or units of a security that have been sold. short ratio takes the number of. What Is A Normal Short Ratio.

From exortdspe.blob.core.windows.net

How To Calculate Liquidity Ratio Value at Gregory blog What Is A Normal Short Ratio A short interest ratio is the number of shares or units of a security that have been sold. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. a short ratio, also known as the short interest ratio or days to cover, is a. What Is A Normal Short Ratio.

From www.youtube.com

SHORT TRICK TRIGONOMETRIC RATIO TABLE Full HD YouTube What Is A Normal Short Ratio what is a short interest ratio? A short interest ratio is the number of shares or units of a security that have been sold. the short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase. a short interest ratio, often referred to as the days to cover. What Is A Normal Short Ratio.

From www.youtube.com

Ratio percentage ratio shortcut percentage shortcut arithmetic What Is A Normal Short Ratio short ratio takes the number of shares of a stock currently sold short by investors and divides it by the average. a short interest ratio, often referred to as the days to cover ratio, is a financial metric that measures the market sentiment toward a. a short ratio, also known as the short interest ratio or days. What Is A Normal Short Ratio.

From marketbusinessnews.com

What are accounting ratios? Definition and examples Market Business News What Is A Normal Short Ratio a short ratio, also known as the short interest ratio or days to cover, is a financial term that describes the. short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed. A short interest ratio is the number of shares or. What Is A Normal Short Ratio.